Recently I changed the way I approach trading system development. Reading A Different Approach to Money Management is what gave me the original idea to alter my approach to trading, but my research is what pushed me over the edge.

Old Way

I approached trading system development with the goal of trying to develop a system with maximum exposure. I didn’t think of running two systems at the same time on the same pool of money (without splitting up the money) if the systems had little/no conflicting signals. Since most of the systems I tested on SPY either had either:

- high exposure but low returns

- high returns (after factoring for exposure) but low exposure

I was left with trying to develop a new system, or trying to trade the system over a large group of stocks (I used the Nasdaq-100 as my stock universe). While I was able to ramp up my exposure to around 70% with any system I tested, I often had to trade 5 or more stocks just to have a reasonable draw-down, which meant that commissions ate a large percent of my trading profits, considering my systems were short term in nature and I have limited capital.

Pros:

- Only one system to manage

- I don’t have to check for as many signals

Cons:

- Not diversified – higher risk

- High commissions due to being forced to trade many stocks to increase exposure

- Can be curve fit easily since I try to develop one super-system

- Higher model risk – there is only one model, which can fail at any given time

New Way

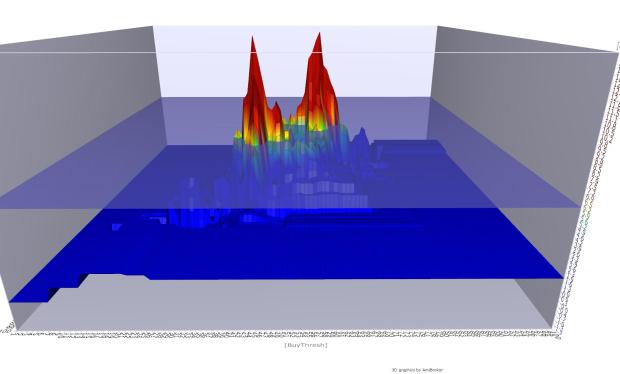

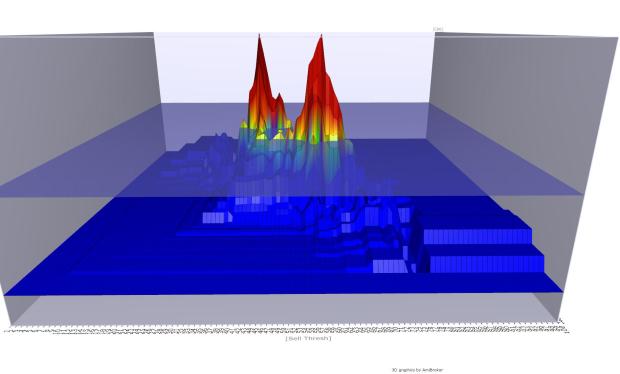

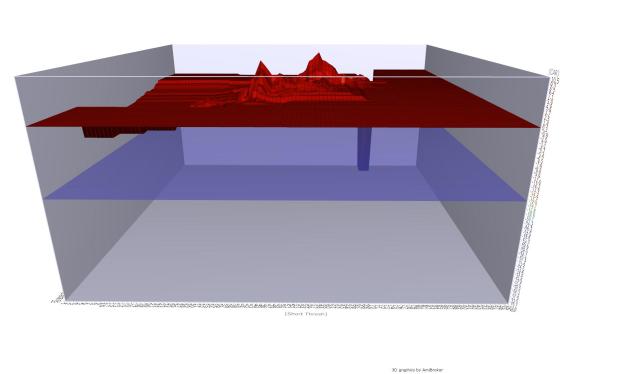

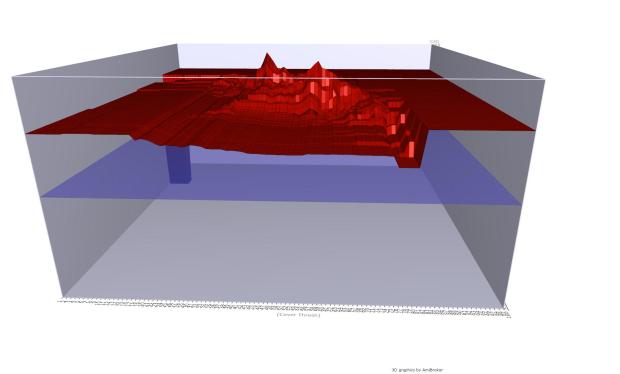

Now, I try to develop multiple systems that have high average profit% per trade with little/no regard for exposure. Even if the system trades only once every two or three months, I can combine many of these systems to trade at a frequency I would be trading at with my old way, but still maintain a highly profitable trading system with lower risk (assuming the systems do not have perfect correlation). While it’s too soon to draw any conclusions from live performance, the historical backtest shows dramatically improved results.

Pros

- Higher returns

- Lower risk

- Lower commissions since I only have to trade one stock (I trade SPY)

- Less risk of curve-fit – I will not be forced to include multiple filters to decrease risk/increase returns

- Lower model risk – chances of multiple models of failing is lower than one model failing

Cons

- Much more of a headache to manage when entering in trades EOD