On my previous two posts regarding pyramiding (first post, second post), I tested three different entry methodologies using a DV2 across multiple securities. To obtain further results of the entry methodology within mean-reversion trading systems, I will test it on a simple IBS system and 2-day RSI system.

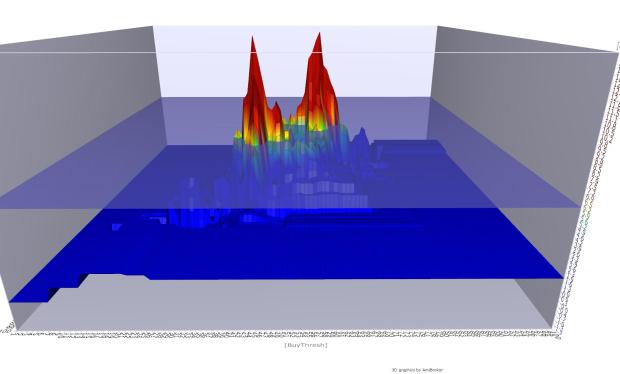

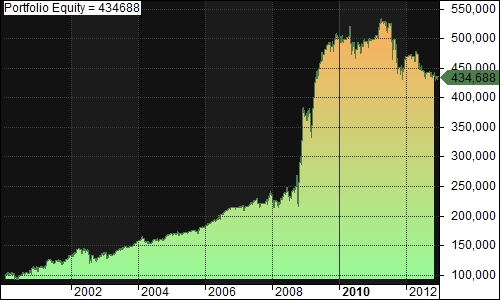

IBS

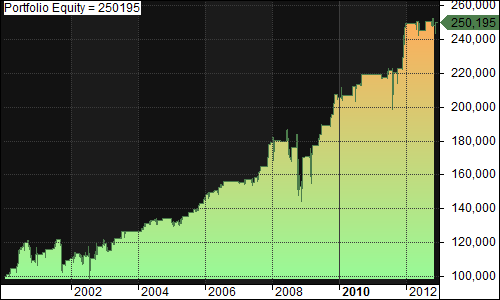

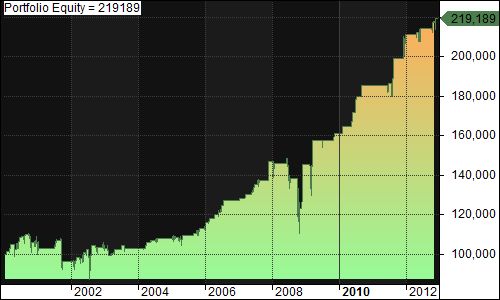

SPY

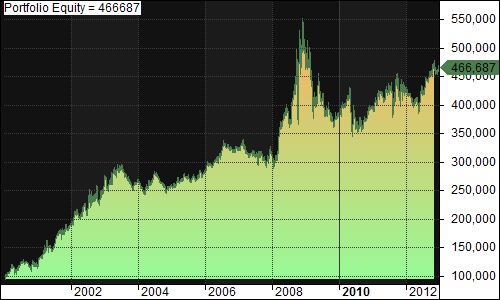

Default (Buy 100% of equity when IBS < 45, Sell 100% of position when IBS > 50):

- Exposure: 42.51%

- CAGR: 10.33%

- MDD: 25.28%

Purchase at first Dip (Buy 100% of equity the first day the close is less than the close of the day IBS < 45, Sell 100% of position when IBS > 50):

- Exposure: 16.57%

- CAGR: 7.38%

- MDD: 15.63%

Scale In(Buy 50% of equity when IBS < 45, Buy 50% of equity more the first day the close is less than the close of the day IBS < 45, Sell 100% of position when IBS > 50):

- Exposure: 28.59%

- CAGR: 8.77%

- MDD: 19.49%

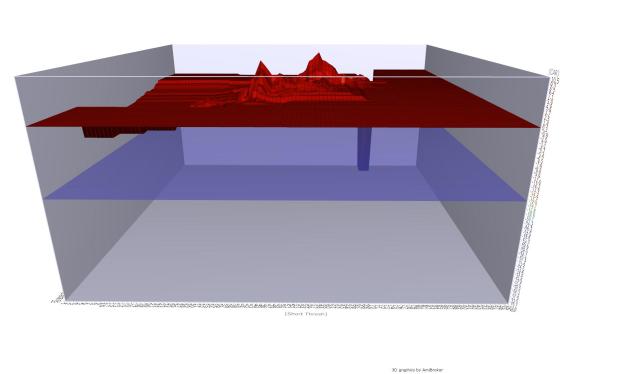

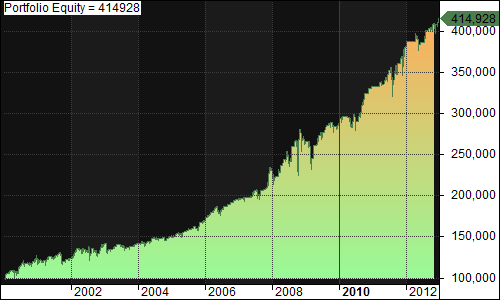

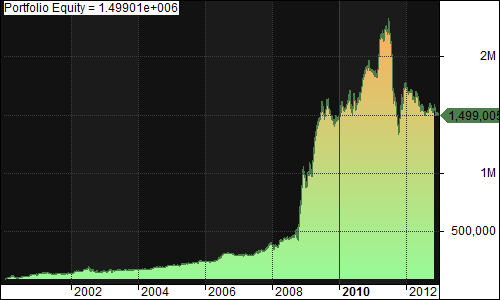

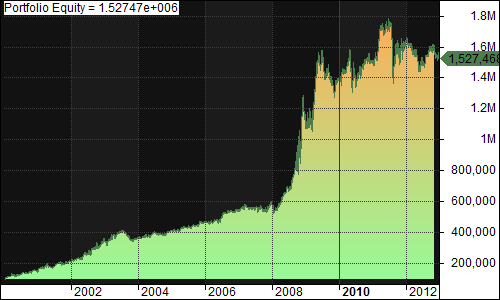

Nasdaq-100

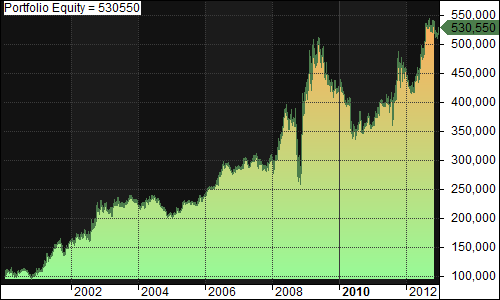

Default(Buy 6% of equity when IBS < 45, Sell 100% of position when IBS > 50):

- Exposure: 77.56%

- CAGR: 24.06%

- MDD: 41.65%

Purchase at a Dip(Buy 18% of equity the first day the close is less than the close of the day IBS < 45, Sell 100% of position when IBS > 50):

- Exposure: 68.46%

- CAGR: 41.04% (Better than DV2)

- MDD: 32.76%

Scale In(Buy 3% of equity when IBS < 45, Buy 3% of equity more on each subsequent day the close is less than the close of the first day IBS < 45, Sell 100% of position when IBS > 50):

- Exposure: 71.42%

- CAGR: 29.46%

- MDD: 40.33%

Individual Nasdaq-100

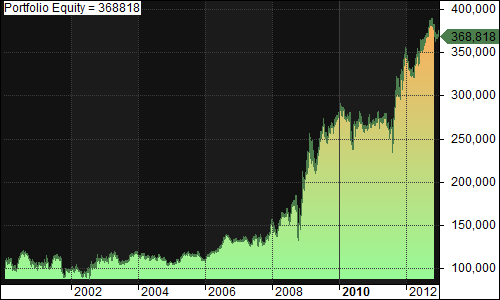

Lastly, I tested a system individually on each Nasdaq-100 stock.

Default(Buy 100% of equity when IBS < 45, Sell 100% of position when IBS > 50):

- Average of Exposure: 44.96%

- Standard Deviation of Exposure: 2.87%

- Average of CAGR: 14.58%

- Standard Deviation of CAGR: 16.04%

- Average of MDD: 29.14%

- Standard Deviation of MDD: 16.11%

Purchase at first Dip(Buy 100% of equity the first day the close is less than the close of the day IBS < 45, Sell 100% of position when IBS > 50):

- Average of Exposure: 17.04%

- Standard Deviation of Exposure: 2.55%

- Average of CAGR: 3.94%

- Standard Deviation of CAGR: 9.06%

- Average of MDD: 21.57%

- Standard Deviation of MDD: 14.23%

Scale In(Buy 50% of equity when IBS < 45, Buy 50% of equity more the first day the close is less than the close of the first day IBS < 45, Sell 100% when IBS > 50):

- Average of Exposure: 30.82%

- Standard Deviation of Exposure: 3.77%

- Average of CAGR: 9.38%

- Standard Deviation of CAGR: 11.37%

- Average of MDD: 23.76%6.96/25.2

- Standard Deviation of MDD: 14.97%

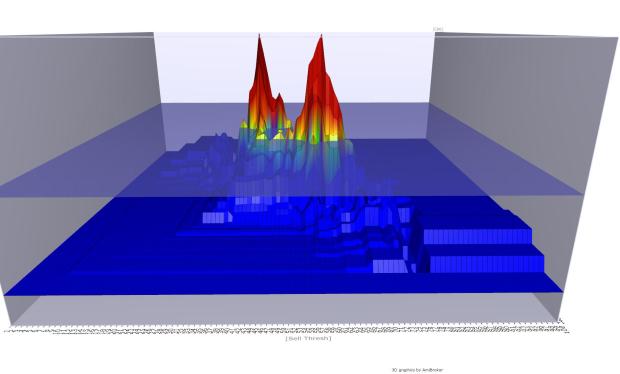

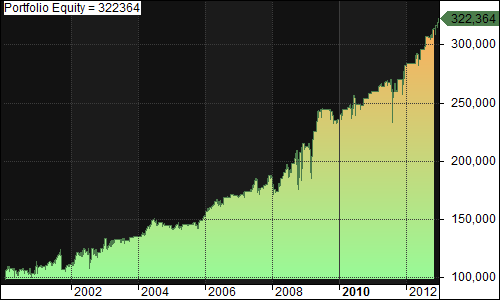

RSI

SPY

Default(Buy 100% of equity when RSI < 50, Sell 100% of position when RSI > 50):

- Exposure: 44.40%

- CAGR: 9.20%

- MDD: 25.90%

Purchase at first Dip(Buy 100% of equity the first day the close is less than the close of the day RSI < 50, Sell 100% of position when RSI > 50):

- Exposure: 25.27%

- CAGR: 6.96%

- MDD: 19.80%

Scale In(Buy 50% of equity when RSI < 50, Buy 50% of equity more the first day the close is less than the close of the day RSI < 50, Sell 100% of position when RSI > 50):

- Exposure: 34.87%

- CAGR: 8.19%

- MDD: 20.34%

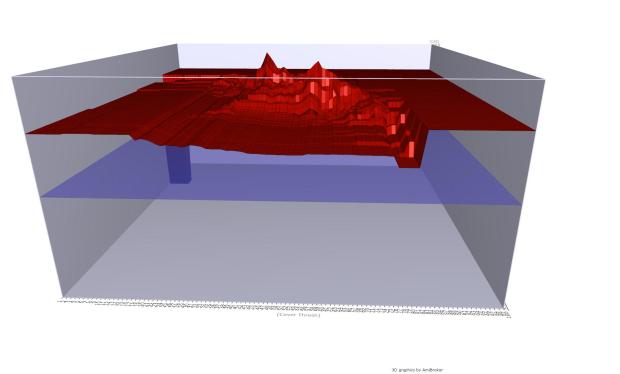

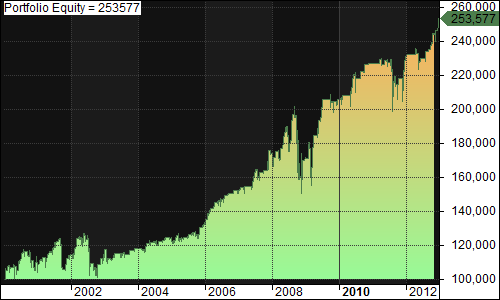

Nasdaq-100

Default(Buy 2% of equity when RSI < 50, Sell 100% of position when RSI > 50):

- Exposure: 68.08%

- CAGR: 19.74%

- MDD: 41.65%

Purchase at a Dip(Buy 6% of equity the first day the close is less than the close of the day RSI < 50, Sell 100% of position when RSI > 50):

- Exposure: 71.59%

- CAGR: 32.28%

- MDD: 31.40%

Scale In(Buy 3% of equity when RSI < 50, Buy 3% of equity more on each subsequent day the close is less than the close of the first day RSI < 50, Sell 100% of position when RSI > 50):

- Exposure: 69.75%

- CAGR: 29.68%

- MDD: 34.54%

Individual Nasdaq-100

Default(Buy 100% of equity when RSI < 50, Sell 100% of position when RSI > 50):

- Average of Exposure: 44.73%

- Standard Deviation of Exposure: 5.85%

- Average of CAGR: 9.03%

- Standard Deviation of CAGR: 11.96%

- Average of MDD: 60.83%

- Standard Deviation of MDD: 21.23%

Purchase at first Dip(Buy 100% of equity the first day the close is less than the close of the day RSI < 50, Sell 100% of position when RSI > 50):

- Average of Exposure: 26.98%

- Standard Deviation of Exposure: 3.39%

- Average of CAGR: 9.03%

- Standard Deviation of CAGR: 10.24%

- Average of MDD: 50.77%

- Standard Deviation of MDD: 20.91%

Scale In(Buy 45% of equity when RSI < 50, Buy 45% of equity more the first day the close is less than the close of the first day RSI < 50, Sell 100% when RSI > 50):

- Average of Exposure: 37.99%

- Standard Deviation of Exposure: 2.19%

- Average of CAGR: 10.27%

- Standard Deviation of CAGR: 11.25%

- Average of MDD: 55.67%

- Standard Deviation of MDD: 21.57%

Conclusion

At a quick glance, it’s clear that purchasing at the first dip for mean reversion trading systems seems to offer the best risk/reward ratio. At times, the differences are marginal, but after factoring for exposure, purchasing at first dip exceeds scaling in in (5/6) tests and the default trading system in (5/6) tests, on an absolute and risk-adjusted basis.