On my previous post, Mean-Reversion Volatility Filters, I used a dynamic volatility filter to filter out trades within a short-term mean reversion system. I came to the conclusion that low vol was conducive for short term mean reversion performance. However, it’s commonly discussed how the market has shifted dynamics some time after the 2007-2008 financial crisis. In this post I revisit the tests ran in my previous post, testing from 1/1/2011 – 4/28/2013 rather than 1/1/1995 – 4/28/2013. The charts displayed below are 10-trade moving average of % profit from 1/1/1995-4/28/2013.

Results

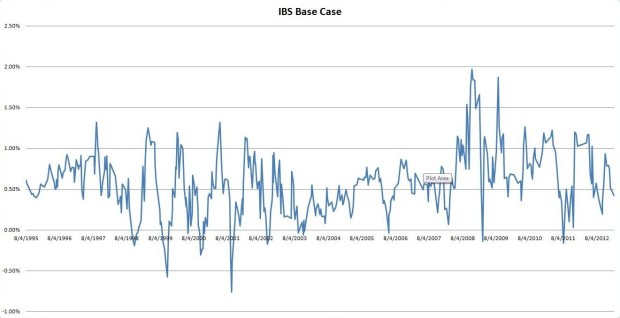

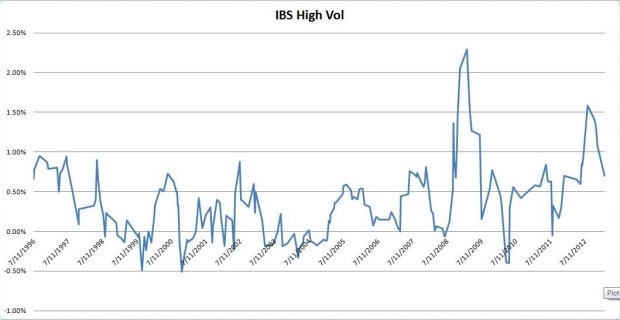

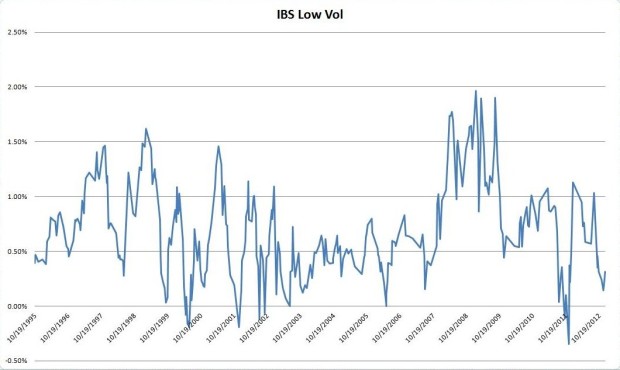

IBS

Rules (Base-Case):

- Buy if 3-Day IBS < 40

- Sell if 3-Day IBS > 40

- Avg. Trade: 0.53%

Rules (High Vol):

- Buy if 3-Day IBS < 40 AND HV(5) > HV(20)

- Sell if 3-Day IBS > 40

- Avg. Trade: 0.68%

Rules (Low Vol):

- Buy if 3-Day IBS < 40 and HV(5) < HV(20)

- Sell if 3-Day IBS > 40

- Avg. Trade: 0.38%

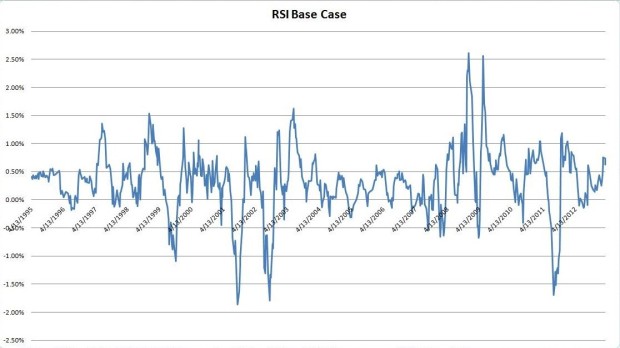

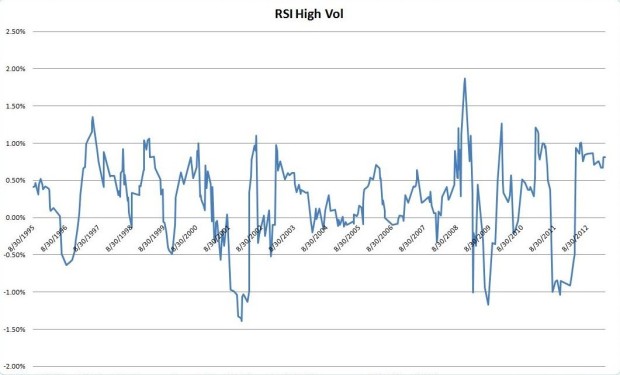

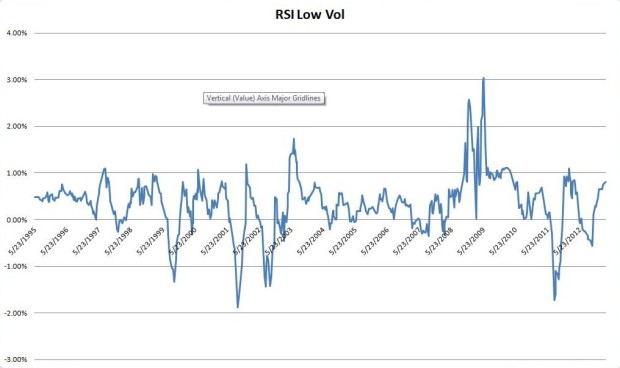

RSI

Rules (Base-Case):

- Buy if 2-Day RSI< 50

- Sell if 2-Day RSI > 50

- Avg. Trade: 0.21%

Rules(High Vol):

- Buy if 2-Day RSI< 50 and HV(5) > HV(20)

- Sell if 2-Day RSI > 50

- Avg. Trade: 0.40%

Rules(Low Vol):

- Buy if 2-Day RSI< 50 and HV(5) < HV(20)

- Sell if 2-Day RSI > 50

- Avg. Trade: 0.10%

Conclusion

Without looking at the charts, it may seem like post 2011, this volatility filter, like many strategies, has completely changed. However after looking at the charts of a rolling 10-trade moving average of % profit. the results become more inconclusive. It seems much more likely that the short term test results are due to unrepresentative and small sample size, rather than a change in volatility filter performance.

What is IBS? How is it calculated? Googling it comes up with nothing.

IBS = Internal Bar Strength. I learned about it from QUSMA’s blog (calculations are in the link). It is a short-term mean reversion indicator.