Something odd that I found:

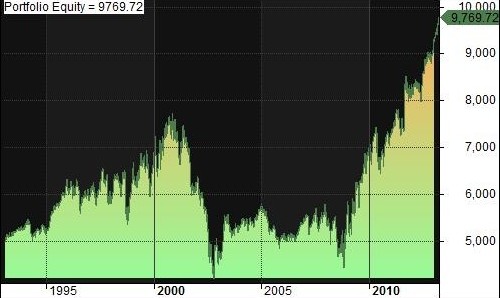

Test 1:

- Buy SPY at close every other trading day

- Sell the next day at close

- 1/29/1993 – 3/25/2013

The 1990’s bull market, and the 2003-2007 market cycle are almost completely missing from the equity curve.

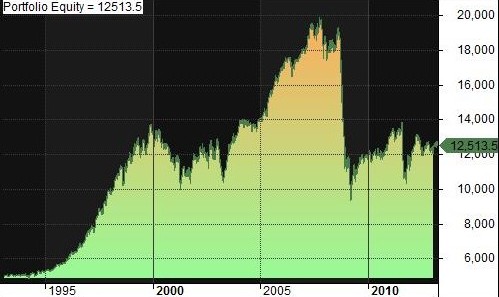

Test 2:

- Buy SPY at close every other trading day

- Sell the next day at close

- 2/1/1993 – 3/25/2013

The popping of the tech bubble and the bull market since 2009 are almost completely missing from the equity curve.

Conclusion:

It’s incredibly strange how trading every other trading day can wipe out the gains/losses of any one cycle (1993-2003, 2003-2007, 2007-2013). What does this mean? Absolutely no idea.

One comment