A while ago CSS Analytics had a post titled Improving Trend-Following Strategies with Counter-Trend Entries, which discusses using a mean-reversion indicator to filter out trades from a trend-following system. It got me thinking about using trend-following philosophy with mean-reversion trading systems. Mean-reversion is based off of buying dips; however, many times oscillators and other mean-reversion indicators are too quick when calling a market dip, and end up losing money the next day or so of an entered trade. To counter-act this tendency, why not use the old trend-following adage to only buy if the trend is up?

To test this, I used my favorite mean-reversion system:

- Buy if DV2 < 50

- Sell if DV2 > 50

- No Shorting

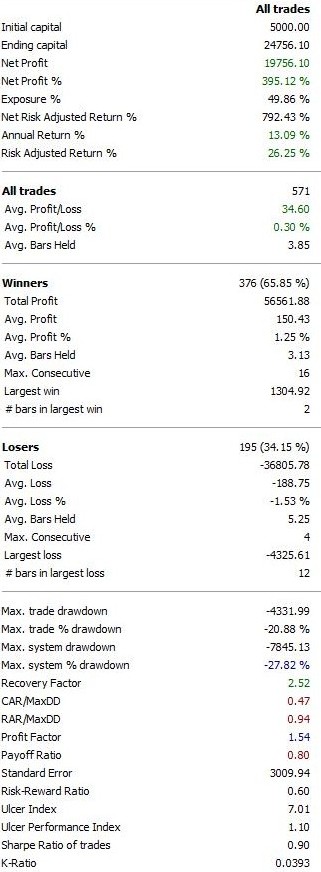

with two variations. Before I go into the two variations, I will post the results of this simple mean-reversion system traded on SPY from 1/1/2000 – 1/1/2013 for comparison. All results are frictionless:

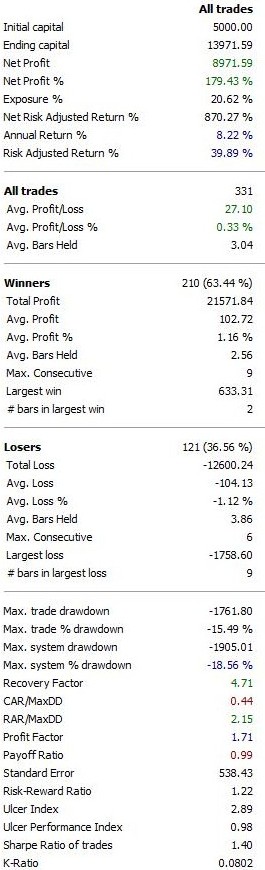

Variation One

- Buy if DV2 < 50 AND Today’s DV2 is ABOVE Yesterday’s DV2

- Sell if DV2 > 50

- No Shorting

Variation Two

- Buy if DV2 < 50 AND Today’s Close is ABOVE Yesterday’s Close

- Sell if DV2 > 50

- No Shorting

Variation One is vastly superior to the simple DV2 strategy when one factors for exposure and maximum drawdown. Variation Two has slightly lower returns when adjusted for exposure, but the maximum drawdown is reduced by 1/3. Using trend-following techniques to filter out bad trades can vastly increase risk-adjusted returns in mean-reversion trading systems.

Very interesting ideas! But I have a simple question: What’s DV2? Appreciate if you can send me a definition or a link to one. Many thanks.

DV2 is a short-term mean reversion indicator created by david varadi from CSS Analytics. Here are a couple of links to start you off:

MarketSci’s posts over DV2

CSS Analytics’ posts over DV2

DV2 Equity Curve

AmiBroker Code

Thanks a lot!

So nice to see an article with a tangible testable system based on logic and testable theory. Most of what I read on the internet about trading is just marketing nonsense of no real value.

I have found, and I have written about this in my blog, that stock market indices perform very well with mean reversion trading systems while currency pairs do not.

I believe the reason for this is the different forces that drive the different markets…

Speculators have access to huge amounts of cash and have done for over a decade – they drive shares and stock market indices up and down in a zigzag manner as they look to buy low and sell high.

These speculators still don’t have enough money to drive the likes of the EUR/USD currency pair however, only central banks and macro-economics can do that.

Therefore stocks tend to revert back towards their means whenever they are over bought or over sold whilst currencies tend to trend. A market cannot be both trending and reverting to it’s mean, at least not on the same time frame anyway.

@williambinghua, thanks for the reply I was wondering the same. Excellent article. Keep ’em coming, please.