Simple mean-reversion trading strategies in US equities have performed poorly since 2010/2011. Mean reversion is not dead, it never will be, but it may expressed differently than previously. Mean reversion prior to 2010, existed mainly in the form of extremes. The more extreme a pullback, the higher chance for a huge reversal. To test this, I ran 10 different frictionless tests on SPY (from Yahoo! Finance) from 1/1/2000 – 1/1/2010.

Rules:

- Buy if the 250-day DV2 is greater than a threshold AND if it is less than the threshold + 10 (this means I will only buy if the DV2 is within a certain 10 point range).

- Sell the next day.

- It is worth noting here that I have an option on in AmiBroker that prevents me from entering buy orders the same day that I enter sell orders, which will lower the overall exposure of these systems.

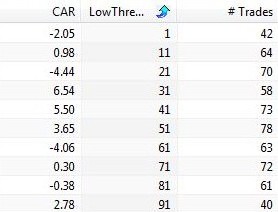

Here are the results:

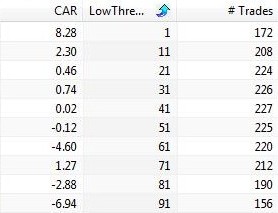

We can clearly see that the returns are largely derived from the 1-11 bucket, meaning that extreme mean reversion was the source of returns. In the past 3 years, mean reversion exists in more moderate forms. Extreme pullbacks no longer indicate large reversals, but moderate pullbacks are more indicative of future gains. To test this, I ran the same test from 1/1/2010 – 1/1/2013:

The returns for the past three years are from the 31-41, 41-51, and 51-61 bucket. The 1-11 bucket went from a 6% CAGR to a -2% CAGR.

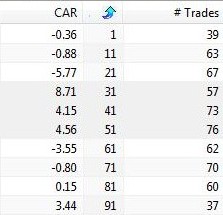

Here are the rules for another test I ran. This should be the result of the above rules if I allowed entries to be entered the same day as exits.

Rules:

- Buy if the 250-day DV2 is greater than a threshold AND if it is less than the threshold + 10 (this means I will only buy if the DV2 is within a certain 10 point range).

- Sell if the 250-day DV2 is less than a threshold OR if it is more than the threshold + 10

Results for 1/1/2000 – 1/1/2010:

Results for the same test for 1/1/2010 – 1/1/2013:

This is only a preliminary test over SPY, but it does lead to avenues for further research.

One comment